|

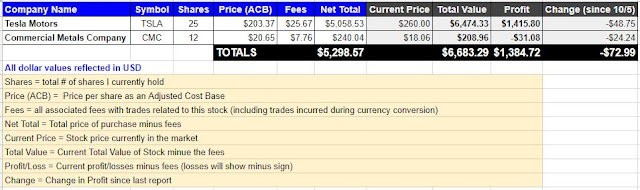

| As of October 19, 2018 closing. |

To prepare, I opened a second trading account, which also happens to be my second Tax-Free Savings Account (TFSA). About 10 years ago in Canada, right around the market crash, this new savings system was launched to encourage middle-class citizens to invest in the economy by providing them a tax-shelter. Essentially, this is a savings account where any investment growth would not be taxed.

Here's a video with a great overview of the TFSA:

Sounds great? Well, I'm just getting started, because there's more!!!

1. The tax-free shelter applies also to dividend payments and capital gains (i.e. rise in stock prices).

This is probably the single most important aspect of the TFSA that most Canadians are not taking advantage of.

Think of it this way: When you have a regular trading account and the shares you buy with it go up in value, the moment you sell the shares and withdraw funds, you are taxed on the gains. But not so if they are in a TFSA.

Let's look at an example. In my case, if you look at my $TSLA shares in the table at the end of this post, you will see that I am sitting at a profit of about $1400. Right now, that growth is in my RRSP trading account. If I was retired and I sell those shares, I will be taxed on those gains. Here in Canada, that can be as high as 46%. So the government is going to take virtually half my earnings, which is around $700! Now think about in 10 years, when I hope to retire early, and the predicted $2000/share happens for $TSLA. That's a 900% profit. That means for every share I sell, the government will tax me about $1000 -- PER SHARE (in an RRSP account, tax includes $100 on the original investment, and $900 on the gains)! And of course, we all have more than one share. Paying an $10,000 tax for only 10 $TSLA shares is an unbearable, but inevitable conclusion.

Now if these were in a TFSA, there's NO TAX. You keep it all. It's that simple.

2. Any growth increases your contribution room.

This is the second greatest advantage of TSFA's that Canadians seems to be unaware of.

When you make a withdrawal from your TFSA, the amount of the withdrawal gets added to your contribution room at the beginning of the next year -- EVEN IF ALL YOU ARE WITHDRAWING ARE GAINS and your original contribution is untouched.

Let's me share another example from my personal experience. I had been putting away funds for years in a TFSA to save up for a grand piano. When I finally was ready to buy, I withdrew the entire balance of my TFSA, including all the interest I had earned. That entire balance, including the interest I earned up until then, showed up as additional contribution room at the beginning of the next year. Now think about a situation where instead of 1.5% interest, I gained 50% on the price of my $TSLA shares and withdrew those funds. Get it?

Simply put, your contribution room grows as big as your investment gains.

This makes gives the TFSA incredible potential on the market if you are someone who is investing for capital growth. If you are aiming to pick stocks for the sole purpose of selling them off when they hit a peak price, it means the amount of your TFSA contribution room could far surpass the standard annual contribution limits.

One warning though. Your contribution room also shrinks with your losses. So if you are unfortunate in picking stocks that cause you capital losses, you cannot recoup those losses in a later year. Consider yourself warned.

2. Reporting Your Taxable Gains is less stressful.

Okay, so actually, I'm new to this part.

I remember the first time I had to report my investment gains on my annual tax report when I was purchasing stocks in a regular trading account. I was tearing my hair out trying to make sense of the forms. I had no idea at the time that you only pay taxes on gains that you withdraw from the account (since you have already paid taxes on the initial investment).

However, when it comes to your TFSA, it's kind of a non-issue. By virtue of having a TFSA, Revenue Canada has your contribution amounts for the year across all your TFSA accounts, and tracks it on their website. Up until now, my TFSA has been with a bank. This is the first time I'll be reporting my investments on my tax report from my TFSA trading account -- if I have to at all. I suspect, it will be similar to my bank, in that it is already automatically reported to CRA for purposes of establishing my contribution room for the following year.

On a different note... what the heck is going on with my CMC stocks? *sigh*

MY POSITIONS FOR TODAY

|

| As of October 19, 2018 closing. |

No comments:

Post a Comment